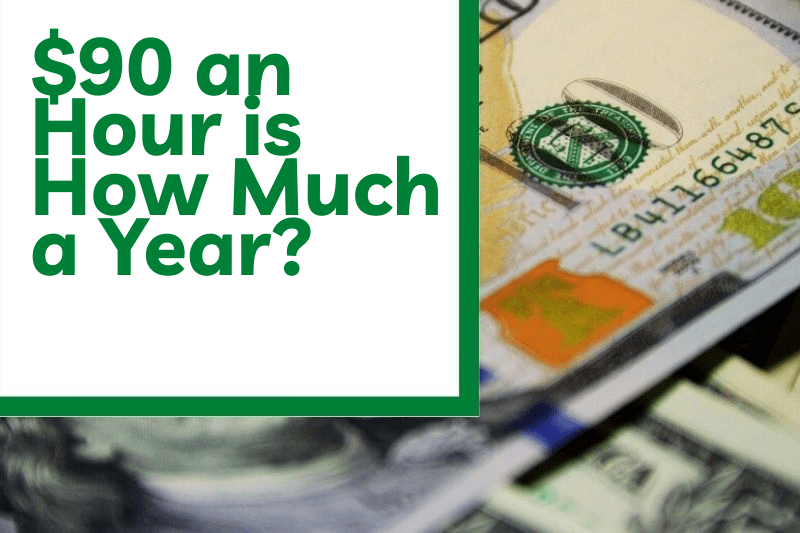

$90 An Hour Is How Much A Year?

| Time Unit | Conversion | Result |

|---|---|---|

| Hourly | 1 hour | $90/hour |

| Daily | 8 hours | $720/day |

| Weekly | 40 hours | $3,600/week |

| Monthly | 160 hours | $14,400/month |

| Yearly | 1920 hours | $172,800/year |

Earning a salary of $180,000 per year is a surefire way to secure a good living. This can be achieved by opting for a job that pays $90 per hour. With this pay rate, you can expect to receive approximately $15,000 per month or $3,750 every two weeks. Breaking it down further, your income would amount to around $7,500 per week and roughly $1,125 per day.

Highest Paying Cities That Pay $90 an Hour

San Francisco, CA stands out as a top-paying city for jobs that offer hourly rates of $90 or higher due to its expensive living costs and flourishing tech sector. The city’s robust economy and fierce job market create abundant opportunities to secure lucrative employment across various industries.

New York City, NY: Renowned for housing some of the most influential companies globally, New York City presents abundant prospects for lucrative employment, with hourly wages reaching $90 or even higher. Moreover, the city boasts a vast reservoir of highly talented professionals who are eager to undertake these roles at competitive rates.

Seattle, WA is a prominent choice for individuals in search of high-paying job prospects, with salaries exceeding $90 per hour. This can be attributed to the city’s flourishing technology industry and the presence of numerous well-compensated professionals in fields like software engineering, finance, and healthcare IT.

Los Angeles, CA: Renowned as a global entertainment hub, Los Angeles also offers ample opportunities for individuals seeking lucrative earnings with hourly wages surpassing $90 in various industries like film production/editing/animation/visual effects, video game development, music production, web design & development, marketing & advertising, and more.

Boston, MA has experienced a surge in popularity among young professionals owing to its lively culture and abundant career opportunities. Various sectors, including biotechnology research & development (R&D), financial services consulting firms (FSCFs), information technology (IT) companies like Google & Microsoft Corporation, and health care providers such as Partners HealthCare System, offer job openings with salaries exceeding $90 per hour.

In Washington DC, there are abundant career opportunities that can reward you with salaries exceeding $90 per hour if you possess specialized skills in government affairs or public policy-making. Additionally, the city houses numerous prestigious think tanks that provide attractive compensation packages, along with perks such as flexible working hours and remote arrangements.

Chicago, IL is widely recognized as one of the top cities in the United States for lucrative job prospects, with hourly wages averaging around $90 or higher. The city’s remarkable expansion in recent times can be attributed primarily to its diverse economy, encompassing various sectors such as manufacturing, finance, education, healthcare, and the hospitality industry. The convergence of these factors renders Chicago an excellent destination for individuals seeking well-compensated employment opportunities.

Austin, Texas is rapidly emerging as a tech startup center, offering numerous lucrative job opportunities, particularly in computer programming, software engineering, data science, and artificial intelligence. The average salary in these fields often surpasses $90 per hour. Moreover, due to the comparatively affordable cost of living in Austin compared to other major US cities, your net income after taxes will still be quite substantial each month.

Denver, Colorado is known for its thriving economy fueled by various industries such as energy mining, aerospace, defense, telecommunications tourism, real estate, construction banking, insurance medical device manufacturing, retail trade, transportation warehousing, utility food service, hospitality professional, scientific, technical business services educational services health care social assistance arts entertainment recreation accommodation travel agencies management consulting administrative support waste management remediation services, and more. These diverse sectors play a significant role in attracting numerous employers who are willing to pay their employees wages surpassing $90 per hour.

10. Atlanta, GA: Atlanta, Georgia is a top-notch choice for those seeking high-paying jobs, with salaries around $90 or more. The city offers a diverse range of industries, including media communications, logistics, automotive aviation, finance, and legal. Moreover, the cost of living in Atlanta is lower compared to many other metropolitan areas in the US, ensuring that net income remains robust even after accounting for taxes and deductions.

Paycheck Calculator

What Jobs Pay $90 an Hour?

A software developer is responsible for designing, developing, testing, and maintaining computer programs and applications. The necessary qualifications for this role include a degree in computer science or a related field, proficiency in programming languages like Java or C++, and familiarity with databases.

A financial analyst assesses investments for businesses or individuals, assisting them in making well-informed decisions regarding their finances. The prerequisites for this role encompass a bachelor’s degree in finance or economics, as well as prior experience utilizing financial data analysis tools like Excel.

A physician assistant is a healthcare professional who operates under the guidance of a doctor to deliver medical treatment to patients. Their responsibilities encompass diagnosing illnesses, requesting lab tests, and prescribing medications when appropriate. To qualify for this role, individuals must possess certification from an accredited program and pass state licensure exams, a prerequisite for practicing in the majority of states.

An air traffic controller is responsible for overseeing aircraft activities within the airspace of an airport. They accomplish this by monitoring radar systems and communicating with pilots through radio transmissions, all while ensuring strict compliance with safety regulations. To become certified controllers eligible for full pay rates, candidates must pass aptitude tests administered by the FAA and complete up to two years of on-the-job training.

A Web Designer/Developer is responsible for both the visual appeal and functionality of websites. They use coding skills such as HTML/CSS to write the necessary code for different browsers and devices. Additionally, they possess design skills in graphic design and are familiar with content management systems like WordPress or Drupal.

Take Home Pay After Taxes for $90 an Hour.

If you earn $90 per hour and are unmarried, your after-tax earnings would amount to around $63.50 per hour. This calculation is based on the fact that the initial $10,275 of your income falls within the 10% tax bracket, resulting in a tax deduction of 10% ($1,027.50).

The income that is left (7925) belongs to the 12% tax bracket, resulting in a tax deduction of 12% from that amount ($951). This brings the total federal tax liability to $1978.50 for working 90 hours, which is approximately 22%. As a result, your take-home pay after taxes can be calculated by subtracting this amount from your gross wages: 90 x 90 = 8100 – 1978.5 = 6121.50 / 90 hours worked = 63.51/hour.

Assuming you and your spouse have equal wages and no additional deductions, if you filed taxes jointly as a married couple or qualifying widow(er), your net pay per hour would amount to around $67. This calculation takes into account the standard deduction allowance for married couples filing jointly, which is currently set at $24,400 for the 2020-2021 tax year.

If you earn the first $25,550, it will be taxed at a rate of 10%, resulting in a federal tax liability of $2,555 on 180 hours worked, approximately equivalent to 14%.

To determine your take-home pay after taxes, you can follow these steps: Multiply your combined gross wages by 180, which equals 16200. Subtract the tax amount of 2555 from this figure to get 13644. Divide this amount by the number of hours worked, which is 180, resulting in a rate of 67 dollars per hour.

Advice For Living on $90 an Hour

When it comes to budgeting, lifestyle choices, expenses, and other financial factors, it is crucial to devise a plan tailored to your needs. Begin by setting practical goals for both yourself and your finances. Ensure these goals are attainable based on your current income. Lastly, after establishing your objectives, construct a budget that will aid you in achieving them.

To begin, establish the practice of monitoring your monthly income and expenses to gain clarity on how your money is allocated. This practice will enable you to pinpoint opportunities for saving or reducing expenses, aligning with your financial objectives. Additionally, remain vigilant for any unanticipated expenses or fluctuations in income, allowing for timely adjustments as needed.

Additionally, it is important to allocate a portion of your monthly income towards savings or investments. This will ensure that funds are readily available in case of emergencies or for future significant expenses like purchasing a car or house. Moreover, it is crucial not to overlook retirement planning. Even with a generous hourly salary of $90, it is prudent to commence saving early, considering the possibility of reduced work opportunities in the future while still having financial obligations to fulfill.